Business Credit Card: Overview, Payments, Adding/Removing Cardholders

RCU's Business Platinum Visa

Select a sub-topic below:

- Overview of Business Credit Card

- How do I Make Payments to my Business Credit Card?

- How do I Add/Remove a Cardholder to my Business Credit Card?

Overview of Business Credit Card

Features of an RCU Business Credit Card:

- Low, variable rates ► View current rates

-

Ability to get cash advances

-

Ability to transfer balances from other credit cards without fees

-

Ability to issue employees separate cards for business expenses

Flexible Options to Meet Specific Needs:

| Option One (One Loan!) |

|---|

|

One Loan |

| One Statement |

| One View in Online Banking (One Loan) |

| One Payment |

| One Line (all cards draw down from one line amount) |

| Multiple cards |

| Ideal for small businesses or sole proprietorship (5 cards or less) |

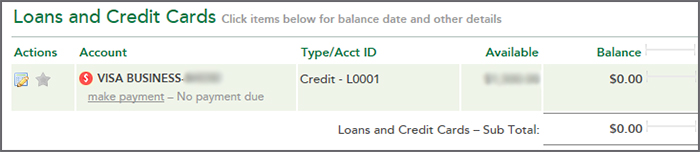

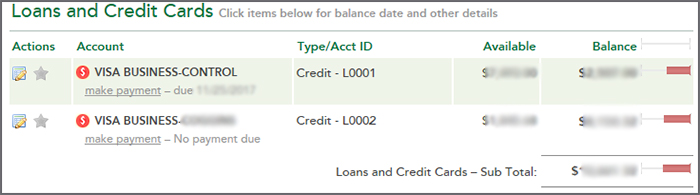

How does this look in RCU Online Banking?

Option One: One Loan

Option Two: Control & Sub Accounts

To change your preferences (option 1 or 2), please contact RCU Card Services at (707)-576-5190 or e-mail them at CardServices@redwoodcu.org.

To apply for an RCU Business Credit Card, click here.

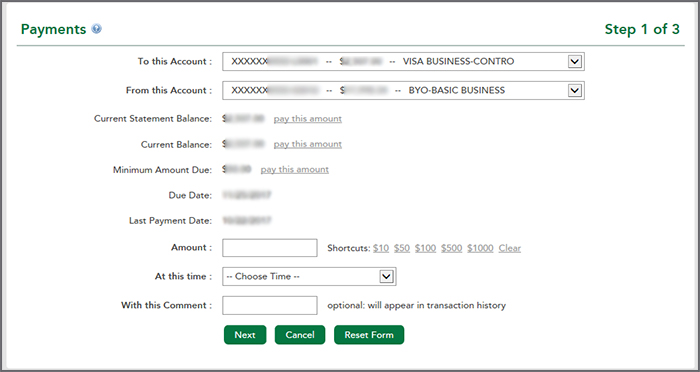

How do I Make Payments to my Business Credit Card?

| Option One (One Loan!) | Option Two (Control & Sub Accounts) |

|---|---|

|

Pay anytime |

Pay to the control account |

RCU offers several payment options for your convenience:

- Online Banking

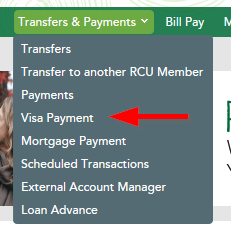

- Sign in to your RCU Online Banking account. In the Transfers & Payments tab, select Visa Payment

- Sign in to your RCU Online Banking account. In the Transfers & Payments tab, select Visa Payment

- Mail Payment

- Kindly mail your payment to the address below:

-

Redwood Credit Union

PO Box 35157

Seattle, WA 98124-5157

-

- Kindly mail your payment to the address below:

- Branch

- To find an RCU branch near you, click here.

How do I Add / Remove a Cardholder to my Business Credit Card?

To remove a cardholder, the business owner must provide a signed documentation stating the request with the following information:

- Name of the cardholder being removed.

To add a cardholder, the business owner must provide a signed documentation stating the request with the following information:

- First and last name of the new cardholder

- Full SSN of the new cardholder

- Date of birth of the new cardholder

- Phone number of the new cardholder

- Credit limit for the new cardholder

Important: If you are set up under Option One: One Loan, the new cardholder will share full credit line. If you are set up under Option Two: Control & Sub Accounts, you will be able to specify the new cardholder's credit limit.

If you are removing a current cardholder and adding a new cardholder at the same time, one signed documentation can be completed with the necessary information mentioned above.

Please turn in your signed and completed documentation to any of our branches.